Real estate interest rates significantly impact financial outcomes for buyers and lenders, affecting the cost of borrowing for homes. Lower rates make homeownership more accessible, increasing demand and fostering competitive lending terms. This stimulates the market with higher sales and property values. Borrowers can maximize savings by refinancing to lower rates and making extra payments, decreasing overall interest paid.

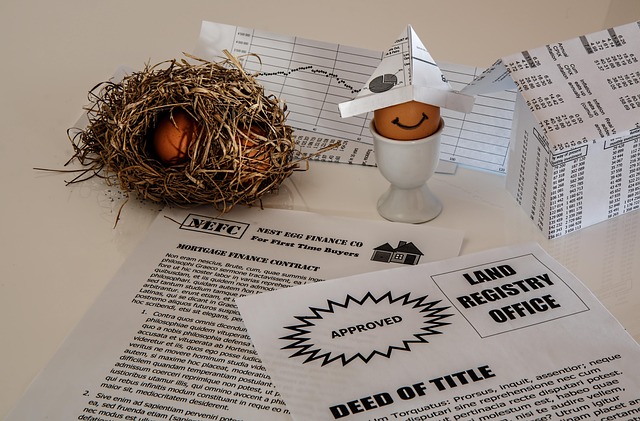

In today’s dynamic real estate market, understanding interest rates is key to making informed decisions. When rates drop, it presents an opportunity for home buyers to secure more affordable monthly payments. This article explores the intricate relationship between interest rates and mortgage payments in real estate, providing insights on how lower rates can significantly reduce financial burdens. We’ll also uncover strategies to optimize savings, empowering readers with valuable knowledge to navigate the complex landscape of home ownership.

Understanding Interest Rates in Real Estate

In the realm of real estate, interest rates play a pivotal role in shaping the financial landscape for both buyers and lenders. Understanding these rates is essential when navigating the process of purchasing a property. When we talk about interest rates in Real Estate, we’re essentially referring to the cost of borrowing money to finance a home purchase or mortgage. This rate is applied to the principal amount borrowed and determines the monthly payment required by the borrower.

Lower interest rates significantly impact real estate markets by making homeownership more affordable. A decrease in rates means that borrowers will pay less interest over the life of their loan, resulting in lower monthly payments. This, in turn, can stimulate demand as prospective buyers find it more enticing to enter the market. Consequently, lenders often compete to offer attractive rates, fostering a competitive environment that benefits potential homeowners.

The Impact of Lower Rates on Monthly Payments

Lower interest rates have a direct and significant impact on monthly payments, especially in the real estate sector. When interest rates decline, it becomes more affordable for borrowers to take out mortgages, as they will pay less in interest over the life of their loan. This leads to lower monthly payments, making homeownership more accessible and attractive to potential buyers.

In the context of real estate, this trend can stimulate the market by increasing demand. With reduced monthly expenses, more individuals and families can afford to enter the housing market, leading to higher sales and potentially driving up property values. This positive feedback loop can create a thriving real estate environment where both buyers and sellers benefit from lower interest rates.

Strategies to Maximize Savings on Home Loans

To maximize savings on home loans, especially with lower interest rates, borrowers can employ several strategies that make their mortgage more affordable and enhance their financial health in the long run. Firstly, refinancing is a powerful tool to capitalize on declining interest rates. By refiing, homeowners can secure a new loan with a lower rate, reducing monthly payments significantly. This is particularly beneficial for those with adjustable-rate mortgages (ARMs) looking to lock in a fixed rate before it increases.

Additionally, making extra payments beyond the minimum due on your mortgage accelerates principal reduction, thereby lowering the overall interest paid over the life of the loan. Even small additional amounts can make a substantial difference, especially with lower rates. This strategy not only reduces monthly expenses but also shortens the repayment period, saving you money in interest and potentially freeing up funds for other financial goals within the real estate sector.