In real estate, understanding and managing closing costs is essential for buyers and sellers to budget effectively. These costs, including title search fees, appraisals, escrow services, agent commissions, property taxes, insurance, legal fees, and inspections, vary based on location, price, and terms. By negotiating fees, comparing mortgage lenders, exploring refinancing options, and reviewing settlement statements, individuals can maximize savings and make informed decisions during the transaction process.

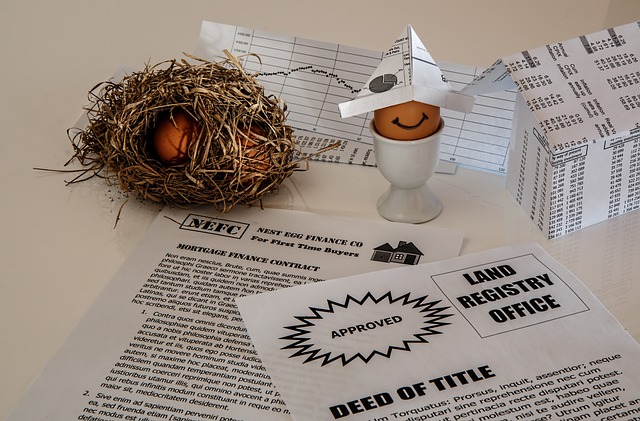

In the dynamic realm of real estate, understanding closing costs is paramount for savvy buyers and sellers. These fees, often overlooked, significantly impact savings potential. This article guides you through the intricacies of closing costs in real estate transactions, elucidating their impact on your financial bottom line. We explore practical strategies to minimize and manage these costs effectively, empowering you to make informed decisions in the complex journey of buying or selling property.

Understanding Closing Costs in Real Estate Transactions

In real estate transactions, closing costs refer to a collection of fees and expenses that are paid at the conclusion of a property sale. These costs can vary greatly depending on factors like the location of the property, the price, and the specific terms of the sale. Understanding closing costs is crucial for buyers and sellers alike as it impacts their financial outlay in a significant way.

Closing costs encompass various elements, including title search fees, appraisals, escrow services, and real estate agent commissions. These charges are often expressed as a percentage of the purchase price or as fixed amounts. For instance, in some areas, buyers may be responsible for paying property taxes and insurance premiums at closing, while sellers might cover legal fees and home inspection costs. Being aware of these components enables both parties to budget effectively and factor these expenses into their overall savings strategy during the real estate transaction process.

The Impact of Closing Costs on Your Savings

When purchasing a property in real estate, closing costs can significantly impact your overall savings and financial plans. These fees, which include various charges and expenses associated with the transaction, are often overlooked but can add up to a substantial amount. From appraisal fees and title searches to escrow services and legal fees, each component contributes to the total cost of buying a home.

Understanding closing costs is crucial in real estate as it allows buyers to budget effectively and make informed decisions. By being aware of these expenses, individuals can adjust their savings strategies accordingly, ensuring they have sufficient funds to cover these charges without compromising their financial stability or long-term savings goals.

Strategies to Minimize and Manage Closing Costs Effectively

When purchasing a property in real estate, closing costs can significantly impact your overall savings and budget. However, there are several strategies to minimize and manage these expenses effectively. One approach is to negotiate with the seller to split or reduce certain fees, such as closing costs and prepaid expenses. Effective communication and a mutually beneficial agreement can result in substantial savings.

Additionally, shopping around for a mortgage lender and comparing loan offers can lead to lower closing costs. Refinancing options, government-backed loans, or alternative financing methods may offer more competitive rates and fewer fees. It’s also advisable to review the settlement statement thoroughly, identifying any charges that seem unusual or unnecessary. Being an informed buyer and understanding the components of closing costs will empower you to make better decisions and maximize your savings in the real estate market.